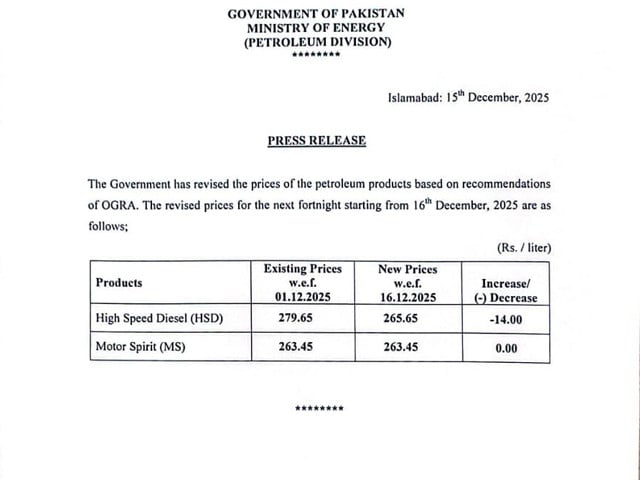

ISLAMABAD: The federal government announced a reduction of Rs14 per litre in the price of high-speed diesel (HSD) and keeping petrol prices unchanged for the next fortnight ending December 31, citing favourable trends in international oil markets.

Furthermore, the decision was communicated through a late-night notification issued by the Petroleum Division, which stated that the revised prices were determined in line with changes in global oil prices and recommendations from the Oil and Gas Regulatory Authority (Ogra).

In this regard, the ex-depot price of high-speed diesel has been reduced by Rs14 per litre, or about 5 per cent, bringing the new price to Rs265.65 per litre from the previous Rs279.65 per litre.

In this sense, the HSD is primarily consumed by heavy transport vehicles, trains, and agricultural machinery such as tractors, tube-wells, threshers, buses, and trucks. Due to its extensive use in the supply chain, changes in diesel prices often have a direct impact on the cost of food items, including vegetables and other essential goods.

Moreover, transport fares remain largely unchanged. Transport operators had raised fares following an increase of approximately Rs27 per litre between May and August and have yet to reverse these increases, even after a cumulative reduction of about Rs9 per litre prior to the latest cut.

Meanwhile, the ex-depot price of petrol has been maintained at Rs263.45 per litre. Petrol is mainly used in private vehicles, motorcycles, rickshaws, and small cars, and its price directly affects household budgets, particularly those of middle- and lower-middle-income groups.

In addition, the general sales tax (GST) on petroleum products remains at zero, the government continues to collect significant revenue through other charges. These include a petroleum levy of Rs78 per litre on diesel and Rs82 per litre on petrol and high-octane products, along with a climate support levy of Rs2.50 per litre.

Additionally, customs duties of approximately Rs16 to Rs17 per litre are imposed on both petrol and diesel, regardless of whether the fuel is locally produced or imported.

Petrol and diesel remain the government’s primary sources of revenue within the petroleum sector, with combined monthly sales averaging between 700,000 and 800,000 tonnes. In comparison, kerosene demand remains limited at around 10,000 tonnes per month.